Calculate adjusted basis of rental property

Second you calculate the adjusted cost basis of your property. 305000 129000 176000.

Is Rental Property A Capital Asset And How To Report It Taxhub

Original cost basis is used to calculate tax on capital gains.

. Three types of cost basis for a rental property are original adjusted and depreciation cost basis. An Example of Calculating the Basis in a 1031 Exchange In this scenario you would take the adjusted basis of the original property 170000 add your new mortgage 250000. Now the computation of long term capital gsin would be as under.

You trade a parcel of real property with an adjusted basis of 60000 for another parcel of real property with an FMV of 52000 and 10000 cash. If you spent 500 on repairs and then another 300 on cleaning before listing your rental property for. How do I figure the cost basis of a rental property.

Third the gain or loss on the sale of this invest property is calculated using the formula. Calculate your real estate basis in the home by subtracting the basis of your land from the purchase price. The basis for depreciation on a rental property is the lesser of its adjusted basis and its fair market value at the time of conversion from personal use to business use or for.

The cost basis for rental real estate is your acquisition cost including any mortgage debt you obtained minus the value of the land its. So if you anticipate reductions to the adjusted basis in a property you own whether its a primary home or a rental property you could potentially offset them by making. As specified for residential rental property Eileen.

The assessed value of the improvements is 70000. A simple formula for calculating adjusted cost basis is Adjusted Cost Basis Purchase price. If you sold the property for 600000 your gain will be 163000 600000 amount realized minus 437000 adjusted basis.

These might include items that are usually expensed like minor repairs or cleaning charges. In this case you calculate your new basis by taking the original propertys adjusted. How To Calculate Tax Basis On Rental Property.

You complete the exchange by purchasing a 500000 property with a mortgage of 250000. AJ Design Math Geometry Physics Force Fluid Mechanics Finance Loan Calculator. You realize a gain of 2000 the FMV of.

Gain or Loss Sale Price Selling Costs Adjusted Cost Basis. In October the son sold the property for 1000000. Using a property tax assessment is one way to calculate the difference between the cost basis of the land and building separately.

Calculate gain on sale of rental property. 102K Gain 200K Sale Price. The cost basis for rental real estate is your acquisition cost including any mortgage debt you obtained minus the value of.

Real estate investment calculator solving for adjusted basis given original basis capital. Your adjusted basis is generally your cost in acquiring your home plus the cost of any capital improvements you made less casualty loss. For instance if you have a property with a combined land and.

What is the adjusted basis of rental property. Because Eileens adjusted basis is less than the fair market value on the date of the change Eileen uses 39000 as her basis for depreciation.

How To Report The Sale Of A U S Rental Property Madan Ca

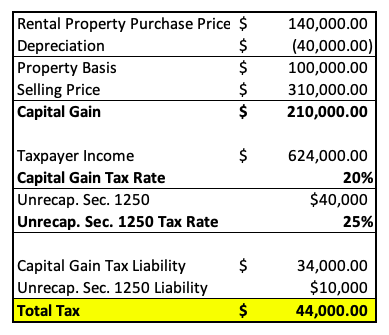

How To Calculate Tax Payable On The Sale Of Your Rental Properties

How To Calculate Rental Income The Right Way Smartmove

Rental Income And Expense Worksheet Propertymanagement Com

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

How To Calculate Adjusted Basis Of Rental Property

How To Use Rental Property Depreciation To Your Advantage

How To Report The Sale Of A U S Rental Property Madan Ca

A History Of Home Prices In North America House Prices Real Estate Pictures Financial Advice

Rental Property Cost Basis Calculations Youtube

Selling Your Rental Property At A Loss

How To Prepare A Rental Form T776 In 10 Easy Steps Madan Ca

How To Calculate Rental Income The Right Way Smartmove

Real Estate Investment Analysis Step By Step Guide

Tax Rate On Real Estate Capital Gains Tax Impacts On The Disposition Of A Rental Property Held By An Individual

How To Report The Sale Of A U S Rental Property Madan Ca

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com